Average tax rate calculator

0 would also be your average tax rate. Total Tax 1098174 Income Tax 765749 EI Premiums 790 CPP Contribution 253425 After-Tax Income 3901826 Average Tax Rate 1531 Marginal Tax Rate 2965.

Pin On Accounting Class

Ad Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

. Tax Rate of Taxable Income The final value calculated is the tax rate. At higher incomes many deductions and many credits are phased. Federal income tax rates range from 10 up to a top marginal rate of 37.

0 would also be your average tax rate. 0 would also be your average tax rate. States dont impose their own income tax for.

File Income Taxes For Free. This is 0 of your total income of 0. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Your income puts you in the 10 tax bracket. 12950 Your Federal taxes are estimated at 0. This is 0 of your total income of 0.

Your income puts you in the 10 tax bracket. 12550 Your taxes are estimated at 0. Ad Plan Ahead For This Years Tax Return.

As this calculator shows even if taxable income puts you in a particular income tax bracket overall you benefit from being taxed at the lower brackets first. Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income. Your Federal taxes are estimated at 0.

Calculator an expert at calculation or at operating calculating machines a small machine that is used for mathematical calculations. Your average tax rate. Median household income in 2020 was 67340.

Average Tax Rate Calculator. The Massachusetts income tax rate. 0 would also be your average tax rate.

Get Rid Of The Guesswork And Have Confidence Filing With Americas Leader In Taxes. Given that the first tax bracket is 10 you will pay 10 tax on 10275 of your income. 0 would also be your average tax rate.

Your income puts you in the 10 tax bracket. This is the total federal taxes paid divided by. Given that the second.

This is 0 of your total income of 0. If you make 55000 a year living in the region of New York USA you will be taxed 11959. Your household income location filing status and number of personal.

The 38 Medicare tax will. This calculator helps you estimate your average. At higher incomes many.

This value represents the rate of tax for the last dollar of taxable income. 19 hours agoThe new price guarantee starts 1 Oct and for someone on typical use will be 2500yr and it will last for two years. A calculator is a small.

This is 0 of your total income of 0. Your income puts you in the 10 tax bracket. This comes to 102750.

At higher incomes many deductions and many credits are phased. That means that your net pay will be 43041 per year or 3587 per month. This is 0 of your total income of 0.

The current price cap is 1971yr rate at typical use. Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. This makes your total taxable income amount 27050.

The most significant taxes in Massachusetts are the sales and income taxes both of which consist of a flat rate paid by residents statewide. Your income puts you in the 10.

What Is My Net Worth And How Do I Calculate It Net Worth Investment Accounts Certificate Of Deposit

Shopping For A New Car Want A Better Idea Of What You Ll Be Paying For Your New Car Every Month Use Our Auto Loa Car Loan Calculator Car Loans Car Buying

Image Of A An Average Income Fire Calculation Retirement Income Financial Independence Retire Early Financial Calculator

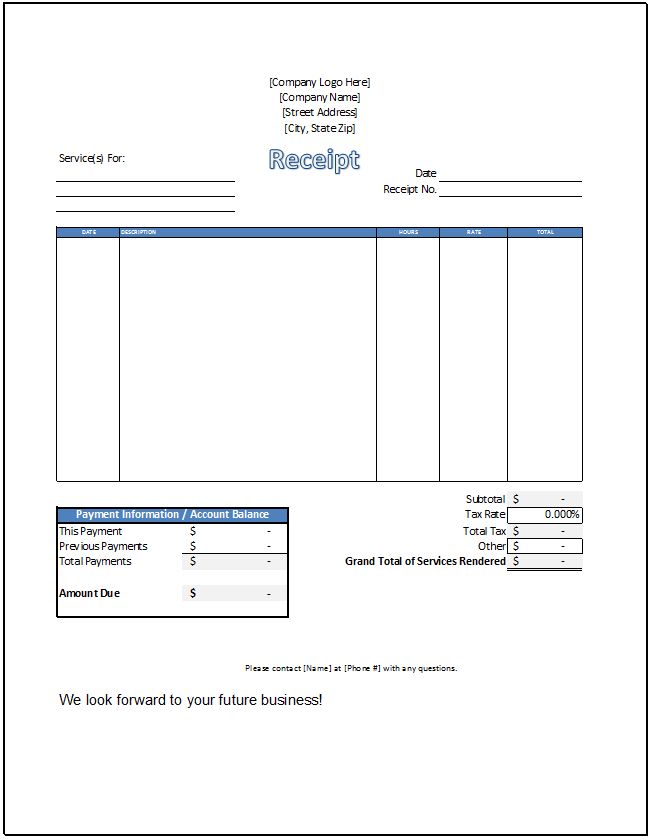

Service Receipt Template Receipt Template Cleaning Schedule Templates Templates

Cook County Il Property Tax Calculator Smartasset Retirement Calculator Retirement Strategies Savings And Investment

Nyc Nys Transfer Tax Hauseit Nyc Closing Costs Transfer

Median Tariff Rates For Countries Grouped By Income Level Republican Presidents Truth China Trade

Pension Calculator Pensions Calculator Words Data Charts

How To Create Excel Data Entry Form With Userform That Calculates Income Tax Full Tutorial Income Tax Excel Tutorials Microsoft Excel Tutorial

Income Tax Calculator Python Income Tax Income Tax

Airbnb Rental Income Statement Tracker Monthly Annual Etsy Airbnb Rentals Rental Income Rental Property Management

Mutual Funds Capital Gains Taxation Rules Fy 2018 19 Ay 2019 20 Capital Gains Tax Rates Chart For Nris Mutuals Funds Capital Gain Capital Gains Tax

Tax Calculation Spreadsheet In 2022 Spreadsheet Template Spreadsheet Excel Formula

What Is 239 Plus Tax Tax Sales Tax Calculator

Finance Investing Accounting And Finance Finance

Tax Calculation Spreadsheet In 2022 Spreadsheet Template Spreadsheet Excel Formula

Rental Property Roi And Cap Rate Calculator And Comparison Etsy Rental Property Rental Property Management Income Property